Topic sinkhole insurance: Discover peace of mind with our comprehensive guide on sinkhole insurance, ensuring your property is protected against unforeseen natural disasters.

Table of Content

- What does sinkhole insurance coverage typically include and exclude in a standard home insurance policy?

- What Is Sinkhole Insurance?

- Who Needs Sinkhole Insurance?

- Coverage Details

- Cost Considerations

- Conclusion

- YOUTUBE: Sinkhole vs Catastrophic Ground Collapse Insurance in Florida

- Introduction to Sinkhole Insurance

- Understanding the Need for Sinkhole Insurance

- What Does Sinkhole Insurance Cover?

- Identifying Areas Prone to Sinkholes

- Evaluating Your Risk for Sinkholes

- How to Get Sinkhole Insurance

- Comparing Sinkhole Insurance Providers

- Cost of Sinkhole Insurance

- Reading and Understanding Your Policy

- Claim Process for Sinkhole Damage

- Preventive Measures and Safety Tips

- Case Studies: Sinkhole Damage and Insurance Claims

- Frequently Asked Questions About Sinkhole Insurance

- Conclusion: Protecting Your Property

What does sinkhole insurance coverage typically include and exclude in a standard home insurance policy?

Sinkhole insurance coverage typically includes:

- Repairing structural damage to your home caused by a sinkhole

- Filling sinkholes that develop on your property

- Coverage for personal property damaged by a sinkhole

- Temporary living expenses if your home is uninhabitable due to a sinkhole

Sinkhole insurance coverage typically excludes:

- Landscaping or land restoration after sinkhole repair

- Damage caused by factors other than sinkholes, such as earthquakes or floods

- Cosmetic damage that does not affect the structural integrity of the home

- Poor maintenance or negligence leading to sinkhole formation

READ MORE:

What Is Sinkhole Insurance?

Sinkhole insurance provides financial protection against losses caused by the formation of sinkholes. This coverage is crucial for property owners in areas prone to sinkhole formation, as it covers the repair costs for damages to the structure and foundation of insured properties.

Who Needs Sinkhole Insurance?

Property owners in regions with a history of sinkhole activity should consider sinkhole insurance. Areas with soluble rock types like limestone are particularly susceptible to sinkholes. Homeowners in such regions are advised to assess their risk and consider additional coverage for peace of mind.

Coverage Details

- Structural Damage: Compensation for damages to the building"s foundation and structure.

- Personal Property: Coverage for personal belongings within the property that may be damaged due to a sinkhole.

- Additional Living Expenses: Provision for temporary living expenses if the property becomes uninhabitable.

Cost Considerations

The cost of sinkhole insurance varies depending on the location, the property"s value, and the level of coverage. In high-risk areas, premiums may be higher due to the increased likelihood of sinkhole formation.

Deductibles

Sinkhole insurance policies often come with a deductible, which is the amount the policyholder must pay out-of-pocket before the insurance coverage kicks in. Deductibles can vary and may be a significant factor in the overall cost of the policy.

Conclusion

Sinkhole insurance is an essential consideration for homeowners in susceptible areas. By understanding the specifics of this coverage, property owners can make informed decisions to protect their investments against the unpredictable nature of sinkholes.

Sinkhole vs Catastrophic Ground Collapse Insurance in Florida

Florida: Immerse yourself in the sun-soaked beauty of Florida, from its pristine beaches to vibrant cities. Explore the diverse landscapes and exciting attractions that make Florida a perfect destination for adventure and relaxation. Coverage: Stay informed and protected with comprehensive coverage that gives you peace of mind. Learn about the importance of extensive coverage options that can safeguard your assets and loved ones in unexpected situations.

All About Sinkhole Coverage with Tower Hill Insurance

In this third installment of our educational video series, Tower Hill\'s Chief Underwriting Officer, Joel Curran, explains how ...

Introduction to Sinkhole Insurance

Sinkhole insurance is vital for protecting your property in areas prone to sinkholes, offering peace of mind against unpredictable natural events. This specialized insurance covers damages to your home and property caused by sinkholes, including structural and foundation repairs, personal property replacement, and even additional living expenses if your home becomes uninhabitable.

Eligibility for sinkhole insurance often depends on geographic factors and sinkhole activity in your area. Insurance companies may require an inspection to assess the risk associated with your property. Understanding the coverage details is crucial, as policies may have exclusions like cosmetic damages and land restoration.

There are two main types of sinkhole insurance: Sinkhole Loss Coverage, which is comprehensive and may be added to your homeowner"s insurance or as a standalone policy, and Catastrophic Ground Cover Collapse Coverage, which is more limited and typically required in high-risk states like Florida. This type of coverage is essential for safeguarding against severe damage and financial loss.

The cost of sinkhole insurance varies based on location, property value, and coverage limits, with policies in high-risk areas like Florida potentially costing upwards of $2,000. Despite the cost, the protection it offers against substantial financial losses can make sinkhole insurance a wise investment, especially in regions known for sinkhole activity.

If you live in a high-risk area or your property sits on soluble bedrock like limestone, it"s recommended to consider sinkhole insurance. In some states, such as Florida and Tennessee, insurers are legally obligated to offer it. Understanding your risk and the available coverage options can help you make an informed decision to protect your property.

Understanding the Need for Sinkhole Insurance

Sinkhole insurance is crucial for safeguarding your home and finances against the unpredictable nature of sinkholes, which can cause extensive property damage. Geographical factors and sinkhole activity in your area play a significant role in determining the necessity for such insurance. Inspections might be needed to assess the risk to your home, influencing your eligibility for coverage.

Sinkhole insurance offers comprehensive coverage for repairing structural damages to your home, including the foundation, and for replacing damaged personal property. However, it"s important to be aware of policy exclusions, such as cosmetic damage and land restoration, which are typically not covered.

Two primary types of sinkhole insurance exist: Sinkhole Loss Coverage, offering broad protection against sinkhole-related damages, and Catastrophic Ground Cover Collapse Coverage, which is more limited and generally required in high-risk states like Florida. Understanding these options is crucial for selecting the right coverage for your needs.

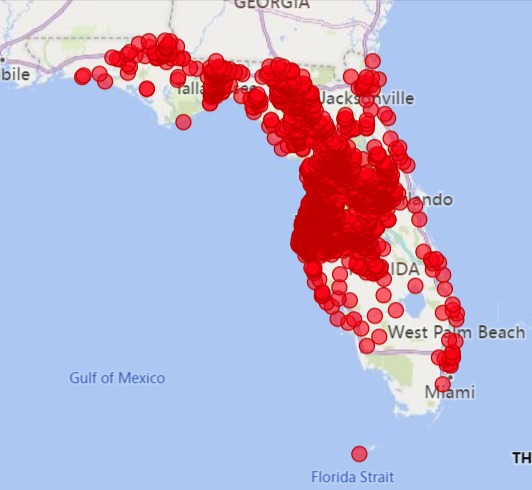

With the U.S. Geological Survey estimating that up to 40% of U.S. land is susceptible to sinkholes, the potential for damage is significant, especially in high-risk states such as Florida, Texas, Alabama, Missouri, Kentucky, Tennessee, and Pennsylvania. The cost of sinkhole insurance varies based on location, property value, and coverage limits, but it can be a wise investment in high-risk areas to protect against severe financial loss.

If you reside in a state prone to sinkholes, it"s advisable to consider sinkhole insurance. It"s especially recommended if your property is on land with soluble bedrock like limestone, or if your lender requires it as a condition for financing. Regular assessments and understanding the signs of potential sinkhole activity can aid in early detection and management.

What Does Sinkhole Insurance Cover?

Sinkhole insurance is designed to protect your home and finances from the damages caused by sinkholes, which can include severe structural issues like foundation problems, cracks in windows and doors, and damage to walls and floors. This type of insurance typically covers:

- Repairs to your home"s structure and foundation.

- Rebuilding of your home and other structures on your property if they are damaged by a sinkhole.

- Replacement of personal property damaged or destroyed by the sinkhole.

- Additional living expenses if you are unable to live in your home during repairs.

It"s important to note that there may be exclusions, such as cosmetic damages, land restoration, and damages caused by negligent acts, intentional damage, or mining activities. Policies can vary by state and carrier, so it"s essential to understand the specific terms and limitations of your coverage.

For instance, in Florida, a distinction is made between Catastrophic Ground Cover Collapse Coverage (CGCC) and standard sinkhole insurance. CGCC applies only when the damage meets certain severe criteria, such as an abrupt collapse that makes the home uninhabitable. In contrast, standard sinkhole insurance may cover repairs to a home that remains habitable after sinkhole damage, provided the damage meets the policy"s criteria.

When considering sinkhole insurance, it"s also crucial to understand the coverage for other structures on your property, personal property, and loss of use, which covers temporary living expenses. Some policies may offer coverage on a replacement cost basis, while others might provide actual cash value, which accounts for depreciation.

Given the potentially catastrophic nature of sinkhole damage and the high cost of repairs, sinkhole insurance can be a valuable addition to your financial protection plan, especially if you live in an area prone to this type of geological activity.

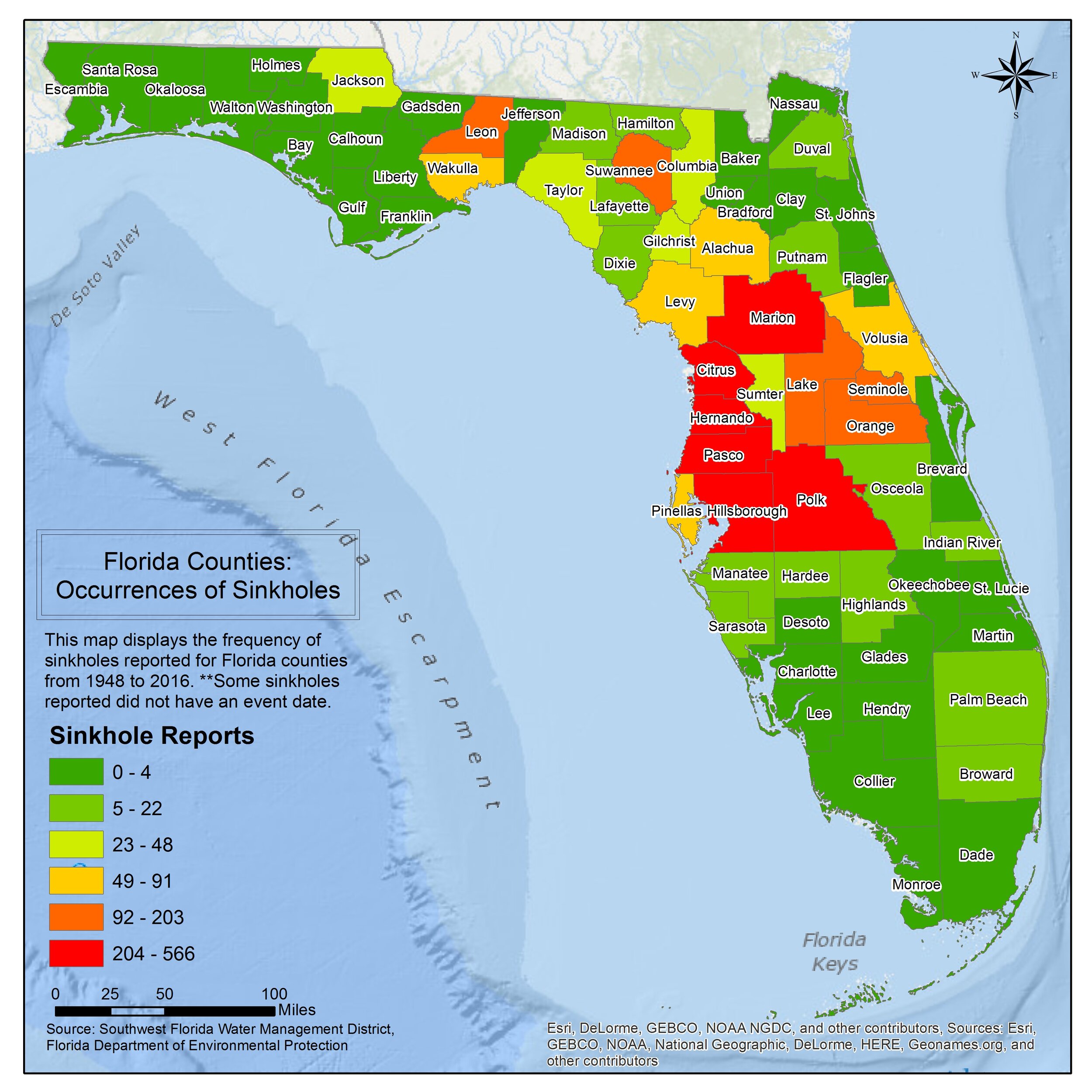

Identifying Areas Prone to Sinkholes

Sinkholes are more likely to occur in regions underlain by soluble geological materials such as limestone, carbonate rock, salt beds, or other types of rock that can be naturally dissolved by groundwater. These conditions lead to the formation of underground spaces and caverns, which, if large enough, can result in the land surface suddenly collapsing. Notable areas prone to sinkholes include Florida, Texas, Alabama, Missouri, Kentucky, Tennessee, and Pennsylvania due to their geological composition.

- Karst Terrain: Sinkholes are most common in karst terrains, landscapes formed from the dissolution of soluble rocks including limestone, gypsum, and dolomite. About 20% of the United States" land surface is considered karst.

- Florida: Florida is particularly known for its high sinkhole activity, especially in the west-central region, due to its karst limestone environment. Weather conditions like long-term weather patterns, heavy acidic rains, and drought-like conditions can increase sinkhole risks.

- Missouri: Missouri has identified approximately 16,000 sinkholes, with the potential for many more unreported ones. The state"s geology, which includes carbonate bedrock capable of karst development, contributes to the formation of sinkholes.

Human activities such as construction, water pumping, and the alteration of natural water drainage systems can also trigger sinkhole formation. Identifying areas prone to sinkholes involves understanding the geological and hydrological conditions of the region, along with the impact of human activities on the landscape.

Evaluating Your Risk for Sinkholes

Evaluating your risk for sinkholes is crucial in protecting your property from unexpected and often catastrophic damage. Sinkholes occur when the ground below the land surface cannot adequately support it, often due to the dissolution of underlying soluble rocks like limestone and carbonate rock by circulating groundwater. This process leads to the formation of underground cavities, which can collapse, causing sinkholes.

Understanding the causes and early warning signs of sinkholes is the first step in risk evaluation. Conditions such as soil erosion, underground caverns, or leaking pipes can compromise the ground over time. Properties in areas with a high prevalence of limestone and other carbonate rocks are particularly at risk, as these soluble bedrock formations naturally dissolve over time.

- Early Warning Signs: Be vigilant for indications of potential sinkholes, including circular depressions on the ground surface, holes in the ground, cracks in the foundation or walls, and tilting or falling trees and fences.

Areas prone to sinkholes in the United States include Florida, Texas, Alabama, Missouri, Kentucky, Tennessee, and Pennsylvania, where certain rock types susceptible to dissolution are common. However, sinkholes can be human-induced by practices like groundwater pumping and construction, which alter natural water-drainage patterns or add substantial weight to the ground.

To minimize your risk, consider a professional geotechnical evaluation, especially if your property is in a high-risk area or if you notice early warning signs. Adequate sinkhole repair and preventive measures can lead to lasting sinkhole prevention and peace of mind.

How to Get Sinkhole Insurance

Obtaining sinkhole insurance involves a few key steps to ensure you"re adequately protected against sinkhole damage. First, assess your risk level by considering if your area is known for sinkholes, which are common in regions with karst terrain. Next, a professional inspection might be necessary, as insurers often require an official evaluation of sinkhole risk before providing coverage.

- Evaluate Your Risk: Determine if your location is prone to sinkholes.

- Professional Inspection: Obtain an official assessment of your property to identify any potential sinkhole risks.

- Shop Around: Compare quotes and coverage options from various insurance providers to find the best fit for your needs.

- Review Costs: Consider the premium rates against the potential sinkhole risk in your area to make an informed decision.

- Select a Policy: Choose the insurance policy that offers adequate coverage with a deductible you can afford.

It"s essential to thoroughly understand the coverage terms, including what is and isn"t covered, to make the best decision for your property.

Comparing Sinkhole Insurance Providers

When comparing sinkhole insurance providers, it"s essential to consider the varied approaches they take towards offering coverage. Some insurers, like USAA, cater specifically to the military community, offering comprehensive homeowners insurance that includes options for sinkhole coverage in states where such phenomena are prevalent. USAA is known for its strong customer service and commitment to the military community, ensuring that families have peace of mind with protective coverage for their homes against unforeseen events.

Chubb homeowners insurance, on the other hand, provides a broad range of coverage options, including sinkhole coverage as an optional endorsement for an additional premium. Chubb"s policies are designed to offer extensive protection for a variety of perils, with a focus on comprehensive, flexible, and customizable coverage to meet the specific needs of homeowners.

Erie homeowners insurance is recognized for its comprehensive coverage options and dedication to customer satisfaction, with over 90 years of experience in the industry. Erie"s policies offer protection against a wide range of perils, including optional endorsements for additional coverage needs, such as sinkhole coverage, depending on the policy and location. Erie is known for its competitive rates, flexible coverage options, and strong community involvement.

When selecting sinkhole coverage, it"s important to assess the coverage options, customer service reputation, and financial stability of the insurance provider. Additionally, considering the location of your property and the level of sinkhole risk in your area can guide you in making an informed decision. Comparing quotes from multiple providers can ensure you receive comprehensive coverage at a competitive price.

To make the best choice for sinkhole insurance, consider consulting with insurance agents or representatives of each company to clarify coverage details, terms, and conditions. This proactive approach can help safeguard your home against the potential risks associated with sinkhole damage.

Cost of Sinkhole Insurance

The cost of sinkhole insurance can vary widely, but it is generally considered a significant expense for homeowners in areas prone to sinkholes. On average, sinkhole insurance premiums can range from $2,000 to $4,000 annually. These costs can sometimes exceed the price of a standard homeowners insurance policy due to the high risk and potential damage associated with sinkholes.

Deductibles for sinkhole insurance are often high and may be set as a percentage of the policy"s dwelling limits. For instance, in some cases, deductibles can range from 1% to 10% of the dwelling coverage limit, meaning that for a policy with $250,000 in dwelling coverage, the deductible could be between $2,500 and $25,000.

It"s important for homeowners to weigh the cost of sinkhole insurance against the potential financial impact of sinkhole damage. In high-risk areas, the protection provided by sinkhole insurance can be invaluable, despite the high premiums and deductibles. Homeowners should consider the geological features of their location, the history of sinkhole activity in their area, and their financial ability to recover from sinkhole damage without insurance coverage when deciding whether to purchase sinkhole insurance.

For those living in states like Tennessee and Florida, where sinkhole activity is more common, insurance companies are required by law to offer sinkhole coverage, often as an endorsement to a standard homeowners policy. In Florida, all homeowners policies are required to include catastrophic ground cover collapse coverage, which provides some protection against sinkhole damage.

Given the complex nature of sinkhole insurance, it"s advisable for homeowners to consult with insurance professionals and conduct thorough research to understand the terms, conditions, and costs associated with sinkhole coverage in their specific location.

Reading and Understanding Your Policy

Understanding your sinkhole insurance policy is crucial to ensuring you are adequately protected. A comprehensive policy covers not only structural damage caused by sinkholes but also includes the costs for stabilizing the ground and preventing further damage. It"s essential to familiarize yourself with the specific terms and conditions of your policy, as coverage can vary significantly.

Most homeowners" insurance policies consist of four main types of coverage:

- Structure or Dwelling Coverage: Rebuilds or repairs your home if it"s damaged by a covered risk.

- Personal Property Coverage: Replaces belongings that are damaged, destroyed, or stolen due to a covered risk.

- Alternative Living Expenses (ALE) Coverage: Helps pay the cost of living elsewhere if your home is declared uninhabitable after a claim.

- Liability Coverage: Helps pay legal costs if someone is hurt on your property.

Be aware that many homeowners insurance policies do not cover land movement, such as earthquakes and sinkholes. To obtain sinkhole coverage, you might need a stand-alone policy or an endorsement to your homeowners policy, although some states require this coverage to be included in standard policies.

Sinkhole insurance can be expensive, often ranging from $2,000 to $4,000 a year, with high deductibles. It"s important to read your policy documents carefully to understand the extent of coverage, deductibles, and any limitations or exclusions that may apply.

If you have any questions or concerns about your policy"s coverage for sinkholes, reach out to your insurance provider"s customer support for clarification. They can provide detailed information and guidance, ensuring you have a comprehensive understanding of your policy.

Remember, the key to effective coverage is understanding your policy"s specifics and staying informed about the protections it offers against sinkholes.

Claim Process for Sinkhole Damage

The claim process for sinkhole damage begins with promptly reporting the incident to your insurance company to initiate the claim. An insurance adjuster is then assigned to assess the damage and estimate repair costs. It"s essential to fully cooperate with the adjuster, providing any requested documentation to facilitate the process.

Here are the key steps involved in the claim process:

- Report the Damage: As soon as you notice sinkhole damage, contact your insurance provider to report the incident.

- Adjuster Assessment: The insurance company will assign an adjuster to evaluate the extent of the damage. This may involve an on-site inspection where the adjuster will take photographs, make notes, and possibly ask questions to understand the damage fully.

- Documentation: Provide the adjuster with any necessary documentation, including photos or videos of the damage, to support your claim.

- Claim Review: The insurance company reviews the adjuster"s report to determine the compensation amount, based on the cost of repairs or replacement and considering your policy"s coverage limits and deductibles.

- Claim Outcome: Once the review is complete, the insurance company will inform you of the claim outcome. If approved, they will proceed with compensation based on the policy terms.

If your claim is denied, you have the option to appeal the decision. Start by understanding why the claim was denied and provide additional evidence or documentation if necessary. If the appeal is unsuccessful, seeking legal advice or professional assistance from a public adjuster might be beneficial.

It"s important to understand your policy"s coverage for sinkholes and any specific terms or conditions that apply. Being proactive and well-informed can significantly impact the outcome of your claim process.

Preventive Measures and Safety Tips

While the unpredictable nature of sinkholes makes them challenging to foresee, understanding the underlying conditions of your area and implementing safety measures can significantly mitigate potential damage. Here are some preventive steps and safety tips to consider:

- Understand Your Area: Familiarize yourself with the geological characteristics of your location, especially if it"s known for sinkhole activity. This knowledge can be crucial in preparing for potential sinkholes.

- Emergency Kit: Maintain an emergency kit that includes non-perishable food, water, basic supplies like a flashlight, batteries, a first-aid kit, and sinkhole-specific items such as rope and protective gear.

- Home Inspection: Regularly inspect your home for signs of structural shifts, including cracks in the foundation, walls, and around doors and windows. Early detection of such changes can be indicative of sinkhole development.

- Pipeline Maintenance: Ensure regular checks on the pipelines within and around your property. Damaged pipelines can exacerbate the development of sinkholes, so it"s advisable to repair or replace them as needed.

- Professional Consultation: Consider consulting with experts for an in-depth assessment of your property and its susceptibility to sinkholes. Professionals can offer tailored advice and solutions to reinforce your home"s foundation.

- Stay Informed: Keep abreast of local news and advisories, especially if you reside in an area prone to sinkholes. Being aware of regional developments can provide crucial lead time in case of emergencies.

- Emergency Protocols: Develop and practice emergency evacuation plans with your household. Knowing how to quickly and safely leave your home can prevent injuries during sudden sinkhole occurrences.

By taking proactive steps and maintaining vigilance for warning signs, you can enhance your readiness against sinkhole incidents and safeguard your property and loved ones.

Case Studies: Sinkhole Damage and Insurance Claims

In a notable case, Kelly and Craig Kubiak successfully represented a long-time USAA policyholder in a dispute following a denial of her sinkhole insurance claim. The case, which involved complex geological concepts and the challenges of proving sinkhole damage, resulted in a $245,000 jury verdict after extensive litigation. The trial highlighted the importance of credible expert testimony and thorough investigation in sinkhole cases, as well as the significant costs associated with bringing such a case to trial. This case serves as a reminder of the challenges policyholders may face when dealing with insurance claims related to sinkhole damage and the potential for litigation to resolve these disputes.

Additionally, the creation of a new comprehensive database by FloodInsights has provided a valuable tool for understanding sinkhole risks. This database, which documents over 15,000 sinkholes and subsidence events in Florida, is designed to assist homeowners, public insurance adjusters, geologists, and geotechnical engineers in identifying and understanding the risks associated with sinkhole formation. The database underscores the widespread nature of sinkholes, extending beyond traditionally recognized areas, and highlights the importance of accurate and accessible information for managing sinkhole risks and insurance claims.

- The Kubiak case illustrates the critical role of expert testimony and the complexities involved in proving sinkhole damage in insurance disputes.

- FloodInsights" database offers a comprehensive resource for identifying sinkhole risks, demonstrating the geographical spread of sinkholes beyond commonly affected counties.

These case studies emphasize the challenges and complexities of dealing with sinkhole damage and insurance claims, highlighting the need for thorough investigation, credible expertise, and access to reliable information.

Frequently Asked Questions About Sinkhole Insurance

Sinkhole insurance is a specialized type of coverage designed to protect homeowners from the financial losses caused by sinkholes. These natural phenomena can cause significant damage to properties, especially in areas prone to their occurrence. Here are some common questions and answers related to sinkhole insurance:

- What is sinkhole insurance and what does it cover?

- Sinkhole insurance is an add-on or separate policy that covers structural damage and possibly personal property damage resulting from sinkhole activity. It may also include additional living expenses if the home is uninhabitable during repairs.

- Who needs sinkhole insurance?

- Homeowners in areas prone to sinkholes, such as Florida, Texas, Alabama, Missouri, Kentucky, Tennessee, and Pennsylvania, should consider sinkhole insurance. The need for this insurance depends on the geological risk of the area and the homeowner"s tolerance for risk.

- How do I know if I need sinkhole insurance?

- Consider the geological makeup of your area, particularly if it includes water-soluble rocks like limestone. Frequent rainfall can increase the risk by dissolving these rocks and forming sinkholes. Consult with local insurance agents or geologists to assess the risk in your area.

- What does sinkhole insurance not cover?

- Typically, sinkhole insurance does not cover cosmetic damages, land restoration, damages caused by man-made activities such as mining, or damage due to mine subsidence. It"s crucial to understand the specifics of what your policy covers and excludes.

- How much does sinkhole insurance cost?

- The cost varies widely based on location, the value of the property, and coverage limits. In high-risk areas like Florida, premiums can be substantial, but they are generally considered reasonable compared to the potential cost of sinkhole damage.

- How can I get sinkhole insurance?

- In states like Florida and Tennessee, insurers are required to offer sinkhole coverage. In other areas, you may need to shop around or consider a stand-alone policy. Insurers often conduct inspections before offering coverage, and properties with existing sinkhole damage may be denied.

- Are there different types of sinkhole insurance?

- Yes, there are mainly two types: Sinkhole Loss Coverage, which covers sinkhole-related damages to structures and personal property, and Catastrophic Ground Cover Collapse Coverage, which is more limited and typically requires a government-declared state of emergency to apply.

It"s essential to consult with insurance professionals to determine the appropriate coverage for your needs and to understand the terms and conditions of your policy fully.

READ MORE:

Conclusion: Protecting Your Property

Understanding and mitigating the risks associated with sinkholes is crucial in protecting your property. While sinkholes are relatively rare, their impact can be devastating, leading to significant structural damage to homes, businesses, and even vehicles. The geological conditions, such as the presence of water-soluble rocks like limestone, contribute to the formation of sinkholes, making certain areas more prone to this natural phenomenon.

Sinkhole insurance offers a layer of financial protection, covering damages to structures and personal property. However, it"s essential to be aware of the limitations and exclusions of such policies, such as coverage for cosmetic damages, land restoration, and man-made sinkholes. The cost of sinkhole insurance varies based on several factors, including location and property value, but considering the potential financial impact of sinkhole damage, it is an investment worth considering for those in high-risk areas.

Deciding whether sinkhole insurance is right for you involves evaluating the geological risks in your area, the specific coverage offered by the insurance, and the financial implications of potential sinkhole damage. Consultation with insurance professionals and geologists can provide valuable insights into the necessity of sinkhole insurance for your particular situation.

In conclusion, the unpredictable nature of sinkholes underscores the importance of being proactive in protecting your property. By understanding the risks, carefully reviewing insurance options, and taking preventive measures, you can safeguard your home and financial well-being against the unforeseen occurrence of sinkholes.

Empower your peace of mind with sinkhole insurance, a wise safeguard for your property in unpredictable terrains, ensuring financial stability amidst the unforeseen.

:max_bytes(150000):strip_icc()/__opt__aboutcom__coeus__resources__content_migration__mnn__images__2018__02__SinkholeSunsetParkBrooklynNYC2015-7a37dc7f44cd42feb4accf2cfc4cc0f6.jpg)